santa clara property tax rate

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

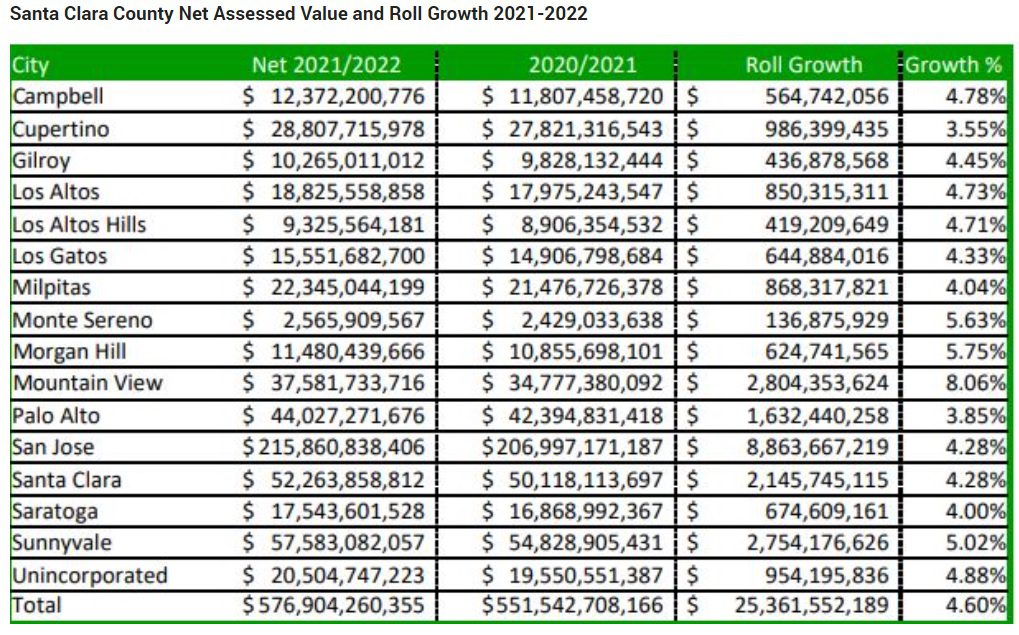

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Whether you are already a resident or just considering moving to Town Of Santa Clara to live or invest in real estate estimate local.

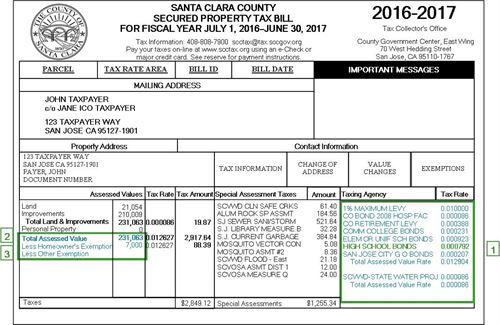

. Use the courtesy envelope provided and return the appropriate stub. The bills will be available online to be viewedpaid on the same day. On your tax bill you will see 1.

Department of Tax and Collections. Santa Clara County property tax rate. San Jose CA 95110-1767.

Property Tax Rates for Santa Clara County The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. By law the tax rate is limited to 1 of the assessed value plus amounts required for the payment of principal and interest on voter approved bond indebtedness. The bills will be available online to be viewedpaid on the same day.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. There are three primary phases in taxing real estate ie devising levy rates appraising property market worth. The median property tax in Santa Clara County California is 4694 per year for a home worth the.

For comparison the median home value in Santa Clara County is. Yearly median tax in Santa Clara County. For example if there is voter.

The budgettax rate-setting process typically. Yearly median tax in Santa Clara County. Should you be currently living here.

Nearly all the sub-county entities have agreements for Santa Clara County to bill and collect their tax. Collections are then disbursed to related taxing units per an allocation agreement. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Santa Clara County collects on average 067 of a propertys. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information.

Every entity establishes its individual tax rate. East Wing 6th Floor. Santa Clara County property tax rate.

With our resource you will learn helpful facts about Santa Clara property taxes and get a better understanding of what to anticipate when it is time to pay. Learn all about Town Of Santa Clara real estate tax. Total tax rate Property tax.

The median property tax in Santa Clara County California is 4694 per year for a home worth the. The Controller-Treasurers Property Tax.

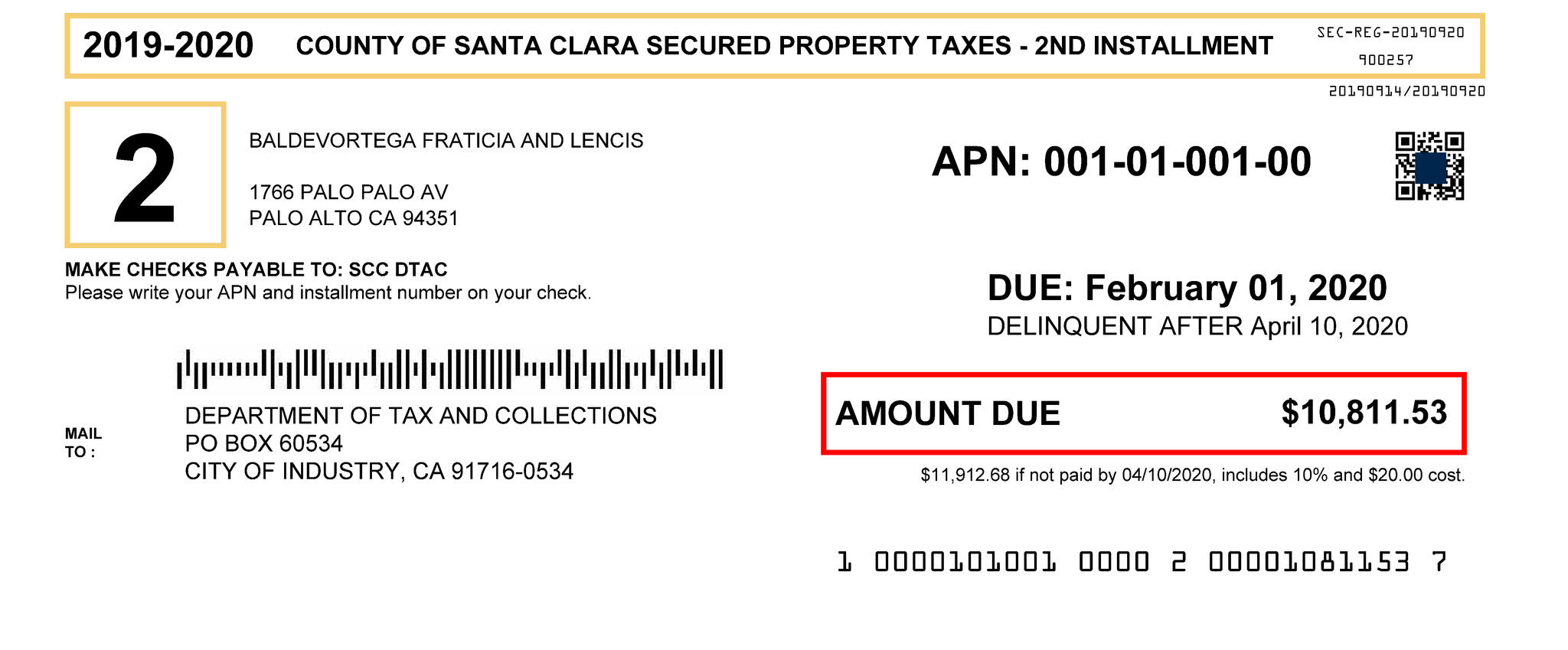

Scc Dtac By County Of Santa Clara

28 451 93 Reasons We Made This Client Smile Shannon Snyder Cpas

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Santa Clara County Ca Property Tax Search And Records Propertyshark

Understanding California S Property Taxes

What You Should Know About Santa Clara County Transfer Tax

East Side Union High School District Bond Measure Faqs

City Of Santa Clara Adu Regulations And Requirements Symbium

Property Tax California H R Block

Understanding California S Property Taxes

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Sponsored Midyear Checkup On Our Bay Area Market It S Hot The Mercury News

Santa Clara County Library District Wikipedia

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Second Installment Of Santa Clara County S 2019 2020 Property Taxes Delinquent After April 10 County Of Santa Clara Mdash Nextdoor Nextdoor

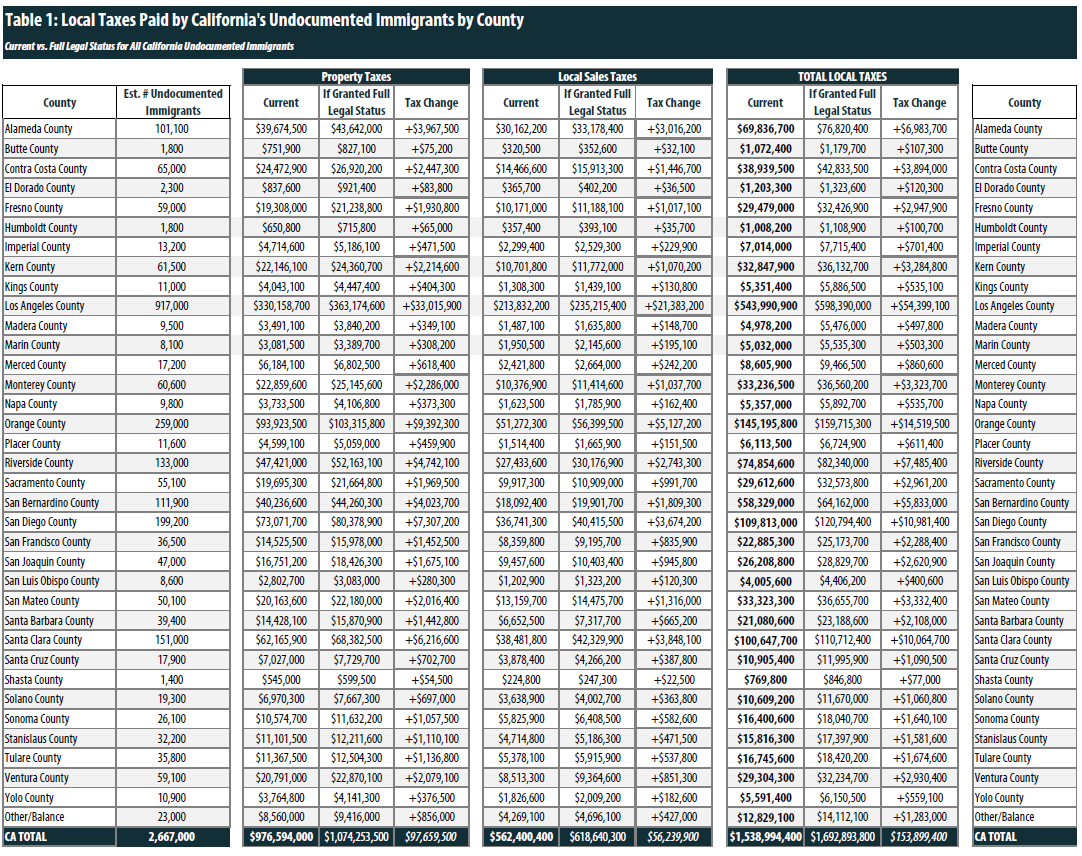

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep